Malpractice premiums for physicians stayed mostly the same in 2014, with 65% of liability insurance rates remaining steady nationwide, according to the Medical Liability Monitor’s annual survey and analysis of premiums nationwide.

Ongoing trends of slow lawsuit frequency and low plaintiff payouts are contributing to the steady market, said Chad C. Karls, editor of the 2014 Annual Rate Survey and a principal and consulting actuary for Milliman in Brookfield, Wis.

“We certainly do see those very large verdicts in the industry, but when we take it across all claims, the vast majority don’t have a verdict attached to them,” Mr. Karls said in an interview. “The vast majority get settled. That average claim has remained relatively stable.”

Unchanging insurance rates, however, can mean payment misery or relief depending on where physicians practice. Internists in southern Florida will pay a high of $47,707 for malpractice insurance this year, while their counterparts in South Dakota will pay just $3,697. For ob.gyns., malpractice insurance is priciest in the New York counties of Nassau and Suffolk, where they will pay $214,999 in malpractice premiums this year. But in Central California, ob.gyns. will pay just $16,240. General surgeons in southern Florida will dish out $190,829 in premiums in 2014, while Wisconsin surgeons will pay $10,868.

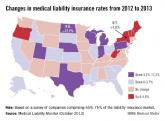

Premiums did increase in some areas in 2014. Indiana physicians saw the highest increase at 4.5%. Nevada doctors experienced a 34.8% decrease in premiums, by far the largest drop among states. (See map.) Nevada’s average percent change was driven by two companies that reported high rate decreases, the survey noted. (Acquisitions by some Nevada insurers may have affected the numbers.)

In general, Nevada’s large rate decline is not surprising, said Dr. Warren Volker, trustee-at-large for the Clark County (Nev.) Medical Society and chair of Premiere Physician Insurance Company in Nevada. Doctors in the state have experienced a stable medical liability climate for the last decade, he said.

“Our premiums have gone down dramatically, across the board,” Dr. Volker said in an interview. “Physicians have enjoyed cost savings as long as they have a good history.”