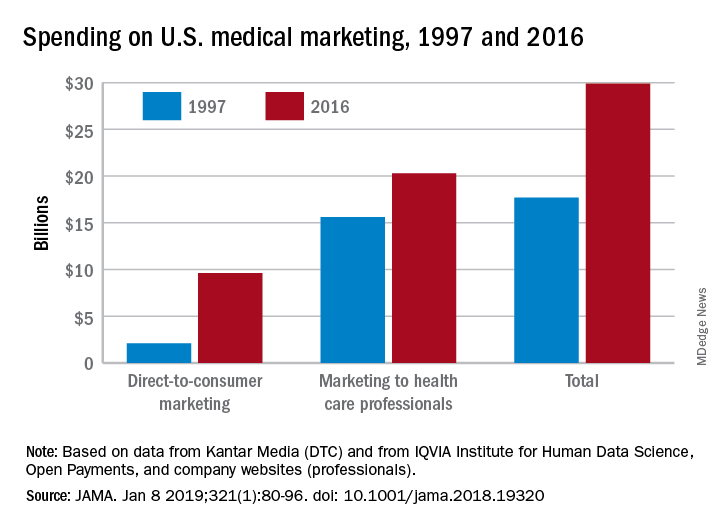

Total spending on medical marketing in the United States increased from $17.7 billion in 1997 to $29.9 billion in 2016, according to an analysis of direct-to-consumer (DTC) and professional marketing for prescription drugs, disease awareness campaigns, health services, and laboratory tests.

“Increased medical marketing reflects a convergence of scientific, economic, legal, and social forces,” wrote Lisa M. Schwartz, MD, and her coauthor, adding that “although marketing expanded over 20 years, regulatory oversight remains relatively limited.” Dr. Schwartz, then codirector of the Center for Medicine and Media at The Dartmouth Institute in Lebanon, N.H., died in November of 2018, after her work was accepted for publication in JAMA.

Dr. Schwartz and her coauthor, David Woloshin, MD, also of Dartmouth, reviewed consumer advertising and professional marketing data, along with searches of medical literature and business journals, to ascertain the quantity and impact of spending. The most money was spent on marketing to medical professionals, which increased from $15.6 billion in 1997 to $20.3 billion in 2016. In terms of percentages, the biggest increase was seen in DTC advertising: $2.1 billion in 1997 (11.9% of total spending) ballooned to $9.6 billion (32.1% of total spending).

These increases were not accompanied by corresponding regulatory efforts to limit influence or protect patients and consumers. In 2016, the Food and Drug Administration’s Office of Prescription Drug Promotion received 97,252 promotional materials that drug companies submitted for review, compared with 34,182 in 1997, but violation letters for prescription drug advertising decreased from 156 to 11. In the same year, the FDA reviewed 41% of core materials – such as risk disclosures and key messages – for new drugs or indications prior to launch, a performance measure the coauthors called “critically important.”

In regard to disease awareness campaigns, 2004 guidance from the FDA on awareness advertising – including standards for unbranded campaigns and recommendations to avoid encouraging self-diagnosis and self-treatment – was withdrawn in 2015 and never replaced. The Federal Trade Commission, which has jurisdiction over unbranded advertising, has not taken regulatory action of its own; any FDA requests for investigation are unknown. In addition, these 2 decades have not seen state attorneys general initiate any action against deceptive consumer advertising, nor has the FTC acted against misleading laboratory test promotion.

“The FDA and FTC should establish and enforce standards for responsible disease awareness campaigns,” the coauthors wrote, “including criteria to validate symptom quizzes (or banning them) and evidence-based strategies to minimize misconceptions that a drug can treat all symptoms of disease.”

Overall, spending on medical marketing actually increased faster than did spending on health services overall. Marketing saw a remarkable 430% increase ($542 million to $2.9 billion) over the 2 decades, while health services spending increased by 90% ($1.2 trillion to $2.2 trillion).

One of the rare similarities from 1997 to 2016 was spending on marketing prescription drugs to physicians, typically through face-to-face meetings and hospital visits; this held steady at approximately $5 billion. However, spending on drug samples increased from $8.9 billion to $13.5 billion, while medical journal advertising declined drastically from $744 million to $119 million.

Spending on DTC marketing of prescription drugs increased across all therapeutic categories but three: cholesterol, allergy, and osteoporosis, each of which saw top-selling drugs either become over-the-counter or lose patent protection. Spending on drugs for diabetes/endocrine disease went from $27 million in 1997 to a whopping $725 million in 2016, followed by dermatology drugs ($67 million to $605 million) and pain/central nervous system drugs ($56 million to $542 million).

The coauthors shared potential limitations of their study, including the likelihood that they underestimated how much is actually spent on medical marketing. “Data on professional marketing (e.g., detailing) of laboratory tests, health services or devices, and pharmaceutical company spending on coupons or rebates, online promotion, and meetings and events could not be obtained,” they noted. In addition, company marketing budgets often do not include additional expenses that should count toward this total, and any published literature on medical marketing’s return on investment is largely based on observational data and cannot be fully relied upon.

The two coauthors previously served as medical experts in testosterone litigation and were cofounders of a company that provided data about the benefits and harms of prescription drugs, which ceased operations in December 2016. No other conflicts of interest were reported.

SOURCE: Schwartz LM et al. JAMA. 2019 Jan 8. doi: 10.1001/jama.2018.19320.