Roth deferral option

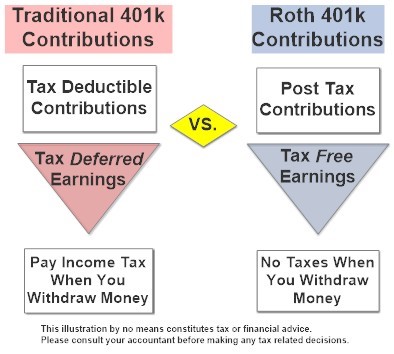

While many folks understand the general ins and outs of how retirement plans work, they fail to realize that there are actually two different types of contributions that can be made in most 401(k)s and 403(b)s: traditional deferrals and Roth deferrals. A traditional deferral is the standard pretax contribution option that lets you skip paying taxes now. Instead, you get taxed at your normal income tax bracket when the money is withdrawn in retirement. This is the option that most people use.

Roth deferrals are posttax contributions. Every dollar contributed gets taxed as ordinary income. Why would one do this, you ask? While there are a variety of different benefits, the primary advantage is that you never have to pay taxes on this money again. To reiterate, you pay taxes on this money now and never have to pay any taxes on it again. This can be extraordinarily helpful in retirement because it gives you the flexibility to choose between taxable and tax-free income.

While you can contribute to personal Roth IRAs to the tune of $5,500 a year if you are under 50 years old and $6,500 if you are 50 years and older, high income earners can be hampered by income limits. For instance, if you make over $135,000 a year as a single person or over $199,000 as a married couple, you are ineligible to make Roth IRA contributions. However, a benefit to Roth contributions in your company 401(k) or 403(b) plan is that these income limits don’t apply. Regardless of your level of income, you can make Roth deferrals in company sponsored retirement plans that allow them.

This strategy is best fit for, but not limited to, those who are earlier on in their careers and can reasonably expect to make much more in the future than they do now. Younger investors have the benefit of time: The more time an investment has to grow, the more it should be worth later on. Also, younger professionals are probably going to be paying the least amount of taxes early in their careers. While not all retirement plans allow for Roth deferrals, if the option is available, why not get taxes out of the way while it’s still relatively cheaper to do so?

More aggressive strategies for those who need to “catch up” on retirement savings

Because many in the medical field have burdensome student loans, saving for retirement is often something that is pushed off by necessity. That being said, there are different ways to start saving more aggressively the closer you get toward retirement.

Catch up contributions. 401(k)s, 403(b)s, and IRAs all have built in “catch up” contributions that allow those aged 50 or older to save more. For instance, up to age 49 years, the maximum annual contribution in a 401(k) or 403(b) is $18,500 for 2018. At age 50 years, you are allowed to add an additional $6000 “catch up” contribution for a total of $24,500 per year. Likewise, IRAs allow for an additional $1000 per year contribution at age 50 years for a $6500 total yearly contribution.

Spousal IRAs. If you have a nonworking spouse, you may be able to contribute to an IRA on his or her behalf. To be eligible for a spousal IRA contribution, you must be married, file a joint income tax return, and have an earned income of at least what is being contributed to the IRAs. This would allow an additional $5,500 to $6,500 in retirement savings per year depending on your spouse’s age.

Simplified Employee Pension IRAs. For those who are self-employed, it could be worthwhile to look into opening up a Simplified Employee Pension (SEP) IRA. These types of retirement plans are similar to traditional IRAs except that they can only be opened up by an employer. The benefit of a SEP IRA is that it allows for a maximum pretax contribution of up to $54,000 or 25% of your total income, whichever is less.

Cash balance plans. For very-high-earning business owners or sole proprietors, saving $24,500 a year pretax in a 401(k) isn’t necessarily going to move the needle all that much. However, there is a plan available that may help tremendously. The cash balance plan is a little known hybrid retirement plan that allows high-earning practices and business owners to put away a serious amount of money in a short amount of time. For instance, an optimally set up cash balance plan would allow a 59 year old to save up to $278,000 in qualified pretax dollars in a single year. Undoubtedly, such plans are one of the most effective and efficient ways to save money for retirement for those who qualify.