When a hospital approached Georgia surgeon Ian Hamilton Jr. about buying his vascular surgery practice, the proposal was too appealing for him to turn down. At the time, Dr. Hamilton’s practice was facing the challenges of meeting new regulatory and business requirements, including the need for a new electronic health record system that would meet meaningful use requirements.

"I didn’t feel that I was going to be able to maintain a solo practice indefinitely," said Dr. Hamilton, who sold his practice in 2013. "I felt something was going to have to change. The reality of what’s happening in American medicine right now makes it very difficult for a solo practitioner at many different levels. It’s become very expensive to be compliant with the Affordable Care Act and the other regulations that are associated with it."

Dr. Hamilton is far from alone in closing up shop because of a more complex and changing health care landscape. Thirty-two percent of physicians who sold their practice within the past 3 years cited the complexities of the ACA as a primary motivator for the sale, according to a nationwide survey by Jackson Healthcare, a health care staffing firm. Of physicians who sold their practices more than 3 years ago, 10% said the law was a factor, according to the survey.

A second survey by Jackson Healthcare found 60% of practice acquisitions by hospitals in 2013 were initiated by the sellers.

"The practice of medicine has increasingly become more complex," said Sheri Sorrell, director of market research for Jackson Healthcare. This includes "getting reimbursement and the amount of paperwork and the amount of regulations [doctors] have to deal with. They can’t keep up with all the regulations. At least if they are selling to a hospital, the hospital has those resources" to comply.

Budding and completed practice acquisitions varied by specialty, the survey found. Nearly 25% of physicians actively seeking to sell their practices described themselves as internal medicine subspecialists, 14% as primary care physicians, and 12% as surgeons. Of the internal medicine subspecialists seeking to sell, 23% described themselves as otolaryngologists, 17% as urologists, and 13% as cardiologists, the survey found.

Hospitals are keen to acquire primary care practices, the second survey found. Family medicine practices made up 58% of practices acquired by hospitals in 2013, while internal medicine made up 40%.

Cardiology practices also are being acquired as physicians seek to avoid significant reimbursement gaps, Dallas health law attorney Cheryl Camin Murray said. Ms. Murray is a shareholder in the health care industry group and corporate securities/mergers and acquisitions practice group of Texas law firm Winstead PC. Hospitals are paid at a higher rate by Medicare than cardiology practices for the same procedures, Ms. Murray said.

While physicians who sell their practices face their share of challenges, the Jackson Healthcare survey found that the majority of doctors who sold are happy with their decision. Fifty-five percent of physicians who sold said they do not miss private practice, and 60% said they are satisfied or very satisfied. Overall, 76% of physician sellers said they would make the same choice again.

One of those physicians is Dr. Hamilton. In the end, he chose not to become an employee of the hospital he sold his practice to, and he is job hunting for nonclinical positions. The sale came at the right time in his practice and career, Dr. Hamilton said.

"For me it was a very good decision," he said. "I’m very happy I was able to get the equity out of my practice that I built over 11 years. For me it was a very timely and very wonderful opportunity."

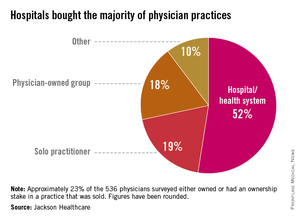

Data in the first survey were collected from 536 physicians across the United States who responded to a survey about practice acquisitions in 2013. The second survey analyzed responses from 123 hospital executives who had completed acquisitions in 2013 or had acquisitions planned for 2014.