with costs for acute leukemia almost tripling that amount, according to a new report from the Leukemia & Lymphoma Society (LLS).

Total allowed cost – the average amount paid by the insurer and patient combined – for acute leukemia was more than $463,000 for the 12 months after initial diagnosis. Averages for the other four cancers included in the analysis came in at $214,000 for multiple myeloma, $134,000 for bone marrow disorders, $131,000 for lymphoma, and $89,000 for chronic leukemia, the LLS said.

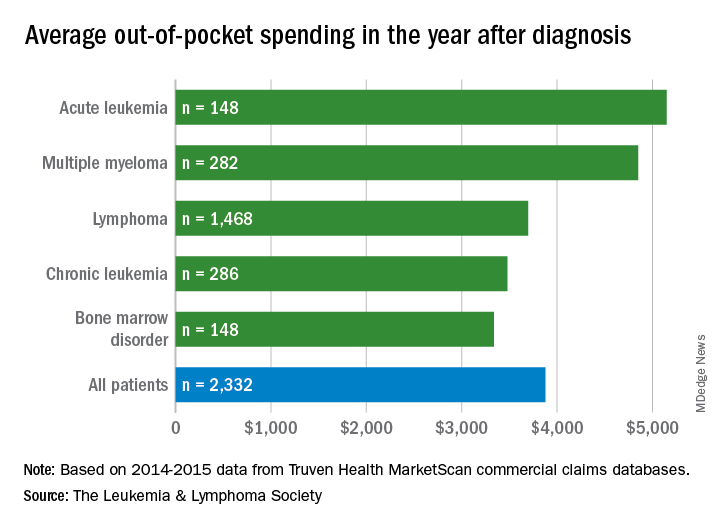

The cost figures are drawn from claims data for 2,332 patients diagnosed in 2014.

Differences in out-of-pocket (OOP) costs were smaller, with the average for all patients at almost $3,900 in the year after diagnosis and acute leukemia coming in the highest at $5,100. Over time, however, OOP costs for multiple myeloma patients became the highest, totaling $9,100 for the 3 years after diagnosis, compared with $8,800 for acute leukemia and an average of less than $7,800 for the other blood cancers, the LLS said in the report, which was prepared by the actuarial firm Milliman.

OOP costs also varied by the type of plan. Patients in high-deductible plans averaged nearly $5,400 for the first year after diagnosis, compared with $3,300 for those with traditional insurance, the LLS noted. For acute leukemia, the OOP costs of high-deductible plans were more than twice as high as those of traditional plans.

The study was based on data for adults aged 18-64 years from the Truven Health MarketScan commercial claims databases for the years from 2013 to 2016. The LLS received support for the study from Pfizer, Genentech, and Amgen.