‘Dramatic restructuring’

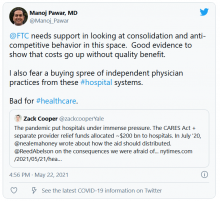

The Federal Trade Commission also has taken note of the trends discussed in the new AMA report, saying that “U.S. physician markets are undergoing a dramatic restructuring.”

The FTC in January announced a study of the impact of the consolidation of doctors groups and health care facilities. FTC is seeking data for inpatient, outpatient, and doctors services in 15 states from 2015 through 2020. To gather this data, the commission has issued orders to six major insurers – Aetna, Anthem, Florida Blue, Cigna, Health Care Service Corporation and United Healthcare.

The FTC is concerned that acquired practices may have to alter their referral patterns to favor their affiliated hospital system over competing hospital systems. But FTC staff also said it might be that these acquisitions result in efficiencies, such as enhanced coordination of care between doctors and hospitals “that outweigh potential competitive harms.”

The research project will likely take several years to complete because of its scope, the FTC said. For that reason, the FTC said its Bureau of Economics will release a series of research papers examining different aspects of this inquiry rather than a single paper containing all of the analyses.

Private equity ‘roll-ups’

On the day the FTC announced the study of the impact of doctors groups, one of the panel’s commissioners argued for a closer look at how private equity firms make their purchases.

In a Jan. 15 tweet, FTC Commissioner Rohit Chopra said his agency needs to challenge their “roll-ups of small physician practices” as well as clinics and labs. This is a practice of using a series of acquisitions too small to trigger the federal threshold for a serious look from the FTC and Department of Justice. (The threshold for 2021 stands around the $92 million mark. This benchmark is known as Hart-Scott-Rodino notification after a 1976 law that set a reporting standard.)

Mr. Chopra attached to his Jan. 15 tweet a 2020 statement in which he called for stepped-up scrutiny of private-equity firms’ acquisitions of doctors’ practices. Mr. Chopra noted that private-equity firms have been buying practices focused on anesthesiology and emergency medicine, fields which triggered consumer complaints about surprise billing for emergency care.

“Given trends in today’s markets, it is critical that the FTC find new ways to ensure the agency has a rigorous, data-driven approach to market monitoring and enforcement,” Mr. Chopra wrote.

A version of this article first appeared on WebMD.com.