A patient called his doctors’ office complaining of postsurgical pain. The practice’s physician assistant recommended increased pain medication, but failed to alert the on-call physician regarding the contact. The patient later sued the PA and the supervising physician after he was diagnosed with compartment syndrome.

But which physician was named in the lawsuit? Not the surgeon. Not the on-call physician. An orthopedist who was out of town during the incident was named as defendant.

The out-of-town orthopedist "was the supervising physician on record," explained Dr. Alan Lembitz, a family physician and chief medical officer for COPIC, a Colorado-based medical liability insurer. "The liability and supervision goes to the doctor who is registered with the medical board."

The vignette goes far to illustrate the type of legal cases that are becoming more common with the increased use of mid-level providers, Dr. Lembitz said.

A report from national medical liability insurer the Doctors Company quantifies the situation.

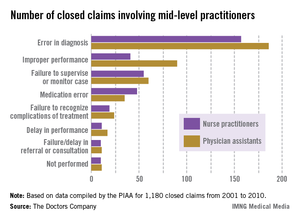

The report examined claims between 2001 and 2010 involving nurse practitioners and physician assistants compiled by the PIAA Data Sharing Project, a claims database operated by PIAA, a national trade association that represents medical liability insurers. (PIAA was formerly known as Physician Insurers Association of America).

Of 1,180 closed claims involving physician assistants (PAs) and nurse practitioners (NPs), the payments were made on behalf of mid-level providers by the supervising physician’s policy or that of the practice’s professional association. Family medicine was the most common specialty associated with claims against mid-level providers.

The average defense payment paid on behalf of NPs was $309,405, while the average defense payment made on behalf of PAs was $321,991, the report said.

With federal incentives aimed at more collaborative care and declining physician reimbursement, the growing demand for physician extenders is inevitable, said George F. Indest III, president of the Health Law Firm, headquartered in Altamonte Springs, Fla.

"With the increased role of [mid-level providers], there will no doubt be some increase in liability placed on physicians who are their supervisors," Mr. Indest said.

Mr. Indest stressed that when used effectively, mid-level providers improve quality of care, fill gaps in medical care coverage, and provide needed treatment for underserved populations. The key is that "supervising physicians must have good rapport with the [mid-level providers] they supervise and keep open channels of communication with them at all times."

Common liability theories

Frequent legal claims faced by physicians supervising mid-level providers include vicarious liability, agency, and failure to supervise.

Vicarious liability assigns liability to a person who did not cause the alleged negligence but who had a legal relationship with the negligent party.

Agency is used to link the negligent acts of one party to another because the two are said to have an agent-principal relationship. In such cases, plaintiffs claim the agent was authorized to act on behalf of the principal.

Failure to supervise is a growing allegation by plaintiffs and by mid-level providers, said Dr. James Szalados, an anesthesiologist and medical liability defense attorney based in New York.

"Inadequate supervision is becoming a bigger issue because mid-levels are using that as a defense," he said. They claim no fault because "the physician did not appropriately supervise."

Physicians also can be disciplined by state medical boards for poor patient outcomes caused by other professionals, according to James W. Saxton, chair of the health care litigation and risk management group at Stevens & Lee, headquartered in Reading, Pa. Most states have supervision requirements that address the oversight of mid-level providers. Running afoul of such rules means state scrutiny.

Boards "take ensuring quality very seriously," Mr. Saxton said. "If you’re a physician supervisor and you don’t have a system in place to make sure you are appropriately supervising your [mid-level provider] and that provider is [operating] outside their scope of practice, the state board can do an investigation of the doctor."

Reducing risk

Knowing your state’s supervision requirements is key to reducing legal dangers and defending potential claims, according to Frank B. O’Neil, senior vice president and chief communications officer for ProAssurance, a national medical liability insurer. Some states allow a broader scope of practice for mid-level providers, while others outline specific intervals that physicians must attend to a patient.

"The bottom line is whenever a physician is employing a [mid-level provider], there are general rules about their duties and supervision laid out by state boards and other regulatory authorities," he said. "It’s imperative to know those regulations and comply with them."