CHICAGO – Administrative hassles are taking too much time and money away from physician practices and the burden is likely to grow as employers ask workers to pay for more of their health care.

That’s the message in the most recent edition of the American Medical Association's National Health Insurer Report Card, released at the organization’s annual House of Delegates meeting.

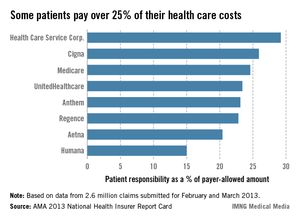

Patients are being asked to cover as much as a quarter of their health care costs, according to the report card. The problem is exacerbated at the beginning of the year, when many must first satisfy a deductible.

Up to half of claims for which insurers pay $0 are those for which the patient owes the full amount, said Mark Reiger, vice president for payment and reimbursement strategy at NHXS, which helped develop the report card.

"As the burden shifts to the patients, more of your revenue is at risk," Mr. Reiger said, noting that "physicians are not very good at collecting patient responsibility."

Payment problems distract from patient care, said Dr. Barbara McAneny of the AMA Board of Trustees. The ABI study found that physician practices are spending as much as 14% of their revenues on getting paid.

You "should not have to divert as much as 14% of your gross revenue to ensure accurate insurance payments for your services," she said.

According to the report card, insurers have improved their performance since the AMA began monitoring it in 2008.

Dr. McAneny said that although things have gotten better, there’s still a lot of money being left on the table – about $43 billion over the last 3 years. That’s how much physicians and insurers have given up due to less than 100% accuracy in claims processing since 2010.

Even so, error rates have dropped from 20% in 2010 to 7% in the latest report.

Medicare was the most accurate payer (98%). UnitedHealthcare was the most accurate commercial insurer (97.5%), while Regence was the least (85%).

The insurers who participated in the report card are Aetna, Anthem, Cigna, Health Care Service Corp., Humana, Regence, UnitedHealthcare, and Medicare.

Insurers were rated according to how quickly they pay claims, how often they pay nothing on a claim, how often they match the contracted fee schedule, whether they disclose the reason for a denial, and a variety of other measures. The report found that the vast majority of claims are paid within 30 days, and most within 15 days. Medicare and Cigna paid 95% of claims within 15 days. In contrast, Aetna paid 66% in the same time frame.

The report shed light on another trend that could lead to more payment problems for physicians: Patients are being required to pay more out of pocket for care. Patients insured by Health Care Service Corp. pay for30% of their care, according to the report card. Most of the other insurers require 20%-25% copays from patients. Humana, on the low end, seeks 15% of the allowable amount from patients.

The AMA is asking payers and vendors to give physicians real-time estimates of the patient’s responsibility at the point of care, Dr. McAneny said.

Among the other findings: Claims denials decreased to 1.8% in 2013, compared with 3% in 2012. Medicare had the highest denial rate at almost 5%.

Insurers also responded more quickly to claims. The fastest, Humana, had a median response time of 6 days, while Aetna was the slowest, with a median response time of 14 days. Medicare matched Aetna, and has maintained that response time since 2008.

Along with the report card, the AMA unveiled its administrative burden index (ABI), which measures how much it costs a practice to rework rejected claims.

Medicare’s performance was not included in the ABI. The ABI score was based largely on the percentage of claims paid after 30 days. The AMA said that the tasks associated with avoidable errors, inefficiency, and waste in the claims process cost an average $2.36 per claim for physicians and insurers. Cigna had the best ABI cost per claim of $1.25 and HCSC had the worst, at $3.32, per claim.

Dr. McAneny said physicians can use the ABI data "to identify the cost of processing claims with the participating health insurers on the report card."

The report card data is based on 2.6 million claims submitted for February and March 2013. It is drawn from 41 states, 80 specialties, and more than 450 practices. It is based exclusively on claims that were submitted electronically and remittances received electronically; therefore, the results may not apply to practices that don’t use electronic submission.