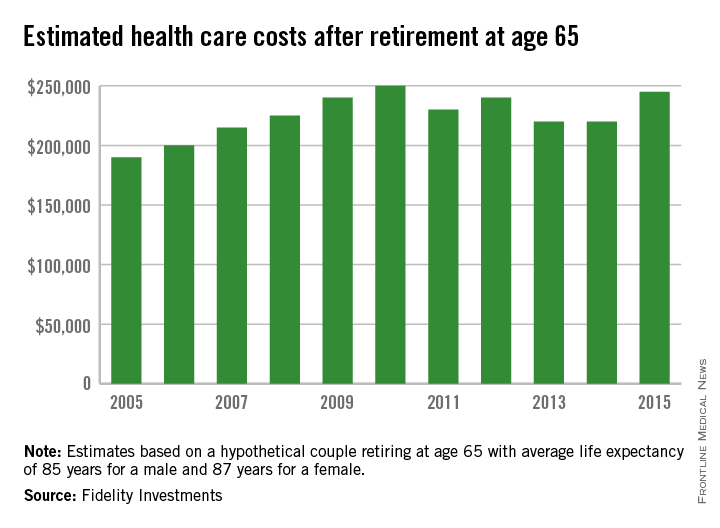

A couple retiring in 2015 at age 65 can expect to pay $245,000 in health care costs over their lifetimes, according to an estimate from Fidelity Investments.

That figure is up 11% from last year’s estimate of $220,000 and has increased 29% since Fidelity’s first estimate in 2005, which came in at $190,000. It is down slightly from 2010, though, when the estimated cost of health care in retirement was $250,000 for a couple.

“Factors boosting this year’s estimate include longer life expectancies and anticipated annual increases for medical and prescription expenses,” Fidelity said in a statement.

A 4%-5% annual rise in health care costs was assumed for the analysis, along with life expectancies of 85 years for a male and 87 years for a female. The estimate does not include the costs of over-the-counter medications, most dental services, and nursing home or long-term care, Fidelity noted.