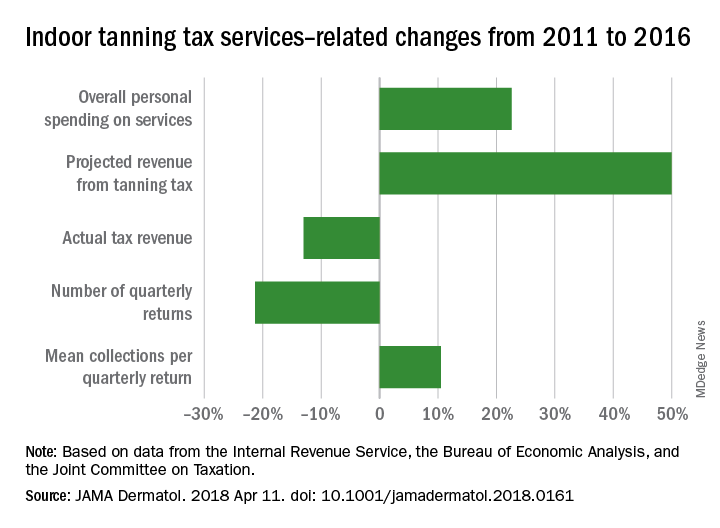

since 2011, despite increased overall spending on services by consumers, according to investigators from the University of Pennsylvania.

Since the Affordable Care Act was passed in 2010 with a 10% excise tax on indoor tanning services, consumer spending, as reflected by collections of that tax, has dropped 13% – from $86.3 million in 2011 to $75.1 in 2016. The amount collected actually increased in 2012 and 2013, when revenue was $91.7 million, making the drop since that peak an even larger 18.1%. Overall personal spending on services, in the meantime, rose steadily from $7.1 billion in 2011 to $8.7 billion in 2016, or 22.6%, Kishore L. Jayakumar and Jules B. Lipoff, MD, said in JAMA Dermatology.

Over that same period, the number of quarterly returns from indoor tanning providers dropped 21.3% as it went from 47,000 to 37,000, with the high point coming in 2013, when the figure was 49,000. Putting the two tax measures together results in mean collections per quarterly return of $1,835 in 2012 and $2,029 in 2016, for an increase of 10.5%, they reported.These findings, when combined with earlier surveys demonstrating “that the prevalence of indoor tanning had been increasing as late as 2009 [imply] a trend reversal coinciding with the tax’s implementation,” but they do not definitively show causation and should be considered “secondary to the public health objective of deterring indoor tanning,” the investigators wrote.

Mr. Jayakumar reported receiving “enrolled agent” status from the Internal Revenue Service. They did not report any other conflicts.

SOURCE: Jayakumar KL et al. JAMA Dermatol. 2018 Apr 11. doi: 10.1001/jamadermatol.2018.0161.